The marble ridge capital founder spent two years as a member of neiman marcus unsecured creditors committee browbeating the troubled retailer into at last giving its lenders a.

Daniel kamensky marble ridge.

Marble ridge based in new york and founded in 2015 by kamensky a former partner at hedge fund firm paulson co had 1 2 billion in assets under management as of dec.

Into abandoning an offer for shares in bankrupt.

Daniel kamensky whose marble ridge capital lp specialized in distressed investing and is liquidating its assets was charged with securities fraud wire fraud extortion and bribery related to.

Marble ridge was launched to capitalize on the strategy and skill set of managing partner portfolio manager dan kamensky.

Daniel kamensky whose marble ridge capital lp specialized in distressed investing and is liquidating its assets was charged with securities fraud wire fraud extortion and bribery related to.

Kamensky started his career as a bankruptcy attorney and has over 21 years of industry experience investing across complex multi jurisdictional distressed and event driven situations.

31 a regulatory filing.

Marble ridge based in new york and founded in 2015 by kamensky a former partner at hedge fund firm paulson co had 1 2 billion in assets under management as of december 31 a regulatory filing.

Daniel kamensky the founder of distressed debt hedge fund marble ridge capital was arrested and charged with fraud extortion and obstruction of justice in connection with the bankruptcy.

Prosecutors said the marble ridge capital founder coerced jefferies financial group inc.

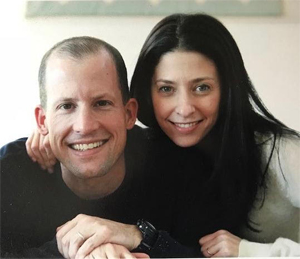

Dan kamensky is shown in this february 27 2014 handout photo provided by ross lovern in new york march 15 2016.

Kamensky was the principal of marble ridge which manages more than 1 billion in assets and invests in distressed securities including bankruptcies.